TRUCKING FACTORING

Trucking factoring (sometimes called freight factoring) is a type of invoice factoring where a trucking company sells its unpaid invoices to a factoring company. The factoring company then gives the business an upfront loan that amounts to a percent of the total invoice value. That percent is typically 75 to 90 percent, although the companies discussed here offer much better. Once the invoice or invoices are paid off, the factoring company sends the rest of the money to the borrower, minus a fee. The fees usually range from 2 to 5 percent a month.

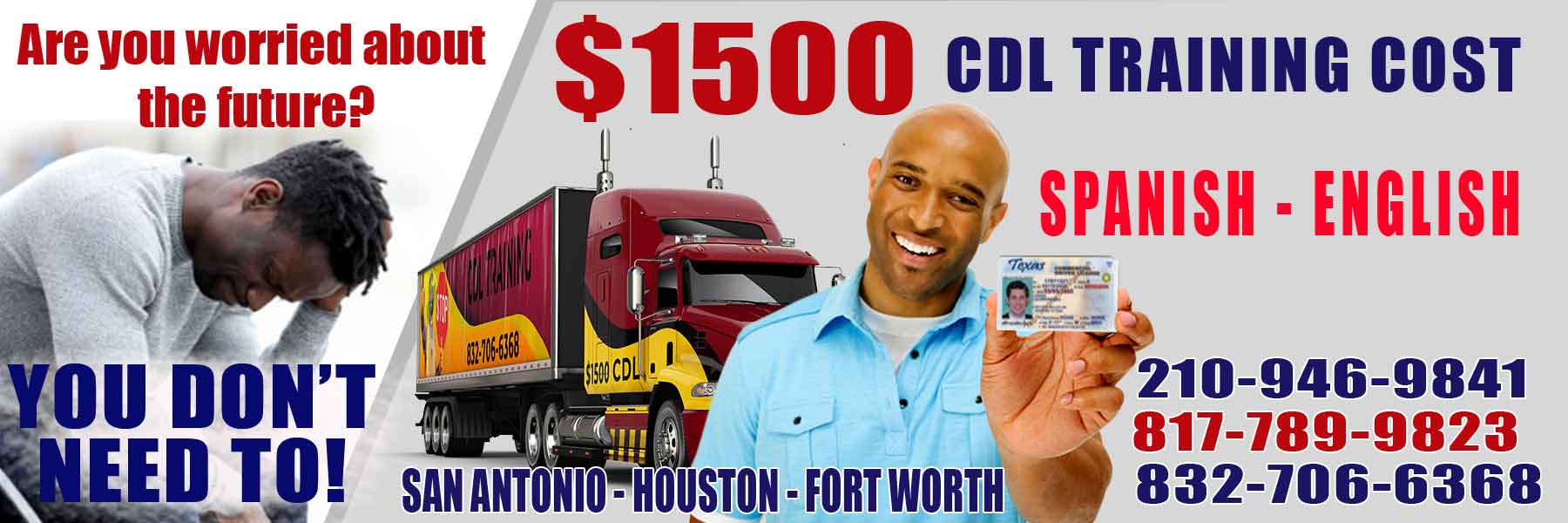

WHEN CDL TRAINING HOUSTON START?

Good question, training starts every day; we understand the Coronavirus changes everything, we can work with your time, just come to the office and tell us about your work-time to redo our schedule.

Request a Callback

PLEASE CLICK IN THE |+| TO SEE THE ANSWER

CAN I PAY IN PAYMENTS FOR CDL TRAINING IN HOUSTON?

Actually, you can pay in payments within the training. Mainly, we want to support the student with the possibility of paying the fees in installments. In addition, we are the lowest price in the market, you will only pay $ 1500.

Currently, we accept 1/2 to enroll this is $ 750 and you can pay the rest in installments within the training. CDL Training Houston knows that COVID-19 weather affects everyone.

WHAT CDL CLASSES HOUSTON INCLUDED?

We are a complete package the training includes all that you see here and much more like:

- Online CLP support is the complete training practice in Spanish-English, all the questions, and answers, with a system like the DMV help you to learn and remember the correct answers in the CLP test, and is FREE, don’t have any cost, is like a courtesy for the students.

- Air Brakes in Cab practice

- The pre-Trip inspection is maybe the hard part because you need to remember the main component in the truck, but, probably is the best DMV modification in the last five years; this process has a significant impact on road security.

- Maneuvers are parallel parking and backing.

- Truck practice, we use the DMV route test to make the training more accurate, in the way we advise about important thing in the road, like security, cross lines, parking, breaking, mirrors.

- Endorsements are tankers, HazMat, Doubles.

- Job placement is support to get a job.

- Online dispatcher training is the best way to know how to make money in the transportation industry and is FREE for the students.

WHERE IS CDL TRAINING IN HOUSTON?

The training delivery classes in the streets are the best way to learn how to drive a semi-truck. The CLP Computer Learning Permit is online; you can use your computer or smartphone to make the practice, available time, and don’t have any cost for our students, including endorsements.

Please call 832-706-6368 and 210-946-9841 before you planning to come 1 hour before we try to protect everybody from the pandemic time. This is the training Area 3698 Beaver Dr Houston, TX 77029 Our Office Address 8179 N Loop East Freeway, Houston, Texas.

WHO TEACHING CDL TRAINING IN HOUSTON?

Expert CDL drivers with experience delivering the training everybody speaks English and Spanish; we have maybe %50 Hispanic students, the success depends on your discipline, study, respect. The training when the student need we support in Spanish.

HOW CDL TRAINING HOUSTON WORKS?

Getting a CDL to start with the CLP is the learning permit; after students pay in the office, we give the Username and password.

The student can practice any day, any time, and available time; after the student passes the CLP in the DMV, our office, just Carmen or Alba the secretaries, will make a new schedule for the truck training practice.

OUR CDL TRAINING IN HOUSTON IS AFFORDABLE?

Yes, we have the best lower price in the CDL schools Houston market, $1500 without extra costs. We do not have any hidden fees; the price included everything you need to get the CDL license.

WHAT IS THE COST CDL TRAINING IN HOUSTON?

We are only $1500 the rest the schools start in $2200 and easily pass $9000; We give the students the chance to pay in payments, this is a perfect thing for some people in the Coronavirus Time (China Pest)

WILL CDL TRAINING HOUSTON HELP JOB PLACEMENT?

Texas is the most significant state in the USA; the oil industry and many more industries are born and grow every day, truck driving schools are a big business,

According to statistics:

Texas has more than 190,000 truck drivers, more than any other state.

Texas’ economy is the second-largest in the country behind California, contributing approximately 9% of the US GDP.

The average salary for a truck driver in Texas is approximately $ 58,000.

Yes, we support students with job placement.

WHY CDL TRAINING HOUSTON IS THE BEST?

Price, Price, and Price are only $1500, no extra cost; you can reach the CDL like the same license when you pay in others schools $9000 or more and is the same license.

WHAT IS CDL TRAINING IN HOUSTON, TX?

In short words, the best way to reach the CDL license and start to work soon. Yes, we help with job placement. People scare because we are only $1500 and other schools are $8000 and much more, de difference in the price is because we teaching you the necessary knowledge to pass the Texas DMV test, other school show the truck for the year, give you conferences about transportation industry, give you coffee and donas. We don do that, we show you the vital, the absolute necessary, to pass and start to work.

DISADVANTAGES TO WORK IN THE CDL INDUSTRY

The live is different for everybody, so please try and get your own history.

- The Family time

- Some time CDL drivers get Cheating and this is hard for the horrible stress, well for some people!

- Fitness need to be a serious task

- Patient when driving, is so important because sometime troubles arise on the road

- Some times Sleep can be a problem

- Personal hygiene can be a problem

- Serious Commitment

- The risk on the road other drivers

- High levels of stress

- Getting a CDL Can Set You Back A Little

- CDL school are Cost Prohibitive, no is our school, we are only $1500

- Weather play some times aggressive and danger

- Absolute Loneliness

FACTORING FEES

The fees can be structured in different ways. A few factoring companies will charge a flat fee (a percentage) and take that right off the top. Others will use a tiered system, a percent charged each week until the invoice is paid. That percent usually goes up the older the invoice gets.

Some companies will take complete control over your invoices, including collecting on your unpaid invoices. There are some, though, like BlueVine or Fundbox, that leave collecting on the invoices to the borrower. Whether that’s a good or bad thing depends on if you want to retain control over your invoices. Some business owners might welcome the chance to hand off collections to someone else while others might not want to confuse or worry their customers by having the factoring company contact them for payment.

FACTORING RISKS

So what happens if your client doesn’t pay their invoice you borrowed against? There are two main types of factoring that determine the outcome:

Recourse factoring — This is when the factoring company can seek payment from you if your client doesn’t pay. That could mean you have to buy back the invoice, or, in some cases, swap out the invoice for a different one. This type of factoring is cheaper because it’s less risky for the factoring company. That’s why it makes more sense to sell the invoices of your customers who pay reliably.

FACTORIS USE TOOLS TO KNOW THE CREDIT SCORE

Non-recourse factoring — In this instance, if your client doesn’t pay, you’re not responsible for repaying the factoring company. However, there are some factoring companies that offer non-recourse financing where you are still responsible for paying the invoice unless the customer declares bankruptcy. Others will assume full responsibility no matter the reason the customer doesn’t pay. Non-recourse factoring is more expensive to the borrower because it’s riskier for the factoring company.

.

Pros and cons of truck factoring

Unlike many small business loans, especially those from traditional banks, it’s fairly easy to qualify for trucking factoring. Factoring companies care more about the creditworthiness of your customers because it’s the customers who pay back the invoices.

Trucking factoring could be a good option for companies that have large amounts of outstanding invoices, need cash quickly to cover expenses like salaries, fuel or to take on new jobs; and don’t have the time or qualifications for a bank loan. Factoring can be expensive, though, especially if your clients take a while to pay off their invoices.

Is cash flow an issue for your trucking business? If so, you should consider freight bill factoring. You need funds to pay expenses and grow your business, and you can’t always afford to wait 30, 60, or even 90 days for customers to pay. Fortunately, invoice factoring can help bridge the gap between when you dropped off a load, and when you get paid for it.

To give you a better understanding of freight bill factoring, we’re breaking down everything you need to know, from the application process to the benefits and more.

TYPES OF FREIGHT COMPANIES WE SERVE

Kinds of trucking companies. Factoring services to provide value to all trucking companies. Whether your trucking company is large or small, new or experienced, and especially for those hauling any type of freight you can benefit from the legendary service Apex provides to help you grow and thrive.

General Freight

Intermodal Trucking

Flatbed Trucking

Step-deck Trucks

Refrigerated Freight

Water Hauling

Sand Hauling

Oil & Gas

Large Equipment

Auto and Car Hauling

Tanker

Hot Shot

Expedite

Oversize

LTL and TL

Dry Bulk

Liquids

Hazmat

What is freight bill factoring?

Freight bill factoring (also known as trucking factoring) is an accounts receivable financing solution that helps trucking company owners improve their cash flow. Essentially, you sell your invoices to a third-party factoring company and quickly receive your funds back (minus a small factoring fee) for your load, so you’re able to use it for day-to-day operations. With freight bill factoring, trucking companies can immediately access funds from slow-paying freight bills.

Freight bill factoring is not a business loan. Instead, it’s a form of invoice factoring. Invoice factoring is both a short-term and long-term solution, and it’s a popular option for cash flow management. It’s an advance based on your invoices. With this advance, you’re able to pay your bills and expand your operations without borrowing funds or taking on new debt.

How does freight bill factoring work?

While trucking factoring involves a particular process, it’s actually very quick and simple. First, you’ll deliver your load as usual. After that, you’ll send a copy of your invoice to a factoring service after you confirm that you’ve delivered the load. If the invoice is approved, the factoring company will deposit money directly into your bank account in as little as 24 hours. After you receive payment, the factoring company will work with your client for payment.

Before deciding on an agreement, it’s important to remember that there are different types of factoring programs with different terms and expectations. Make sure you ask about some of the benefits of each program, and how it might affect your business before signing.

Non-recourse factoring ensures that even if your customers are slow to pay, you’ll be able to fill any cash flow gaps. This is because the factoring company assumes responsibility and protects your business from customer insolvency. That means if your customer goes bankrupt, the factoring company will not attempt to collect those unpaid invoices from you.

While non-recourse factoring is a great option for small, independent owner-operators, larger companies will typically use recourse factoring because of their potential reserves to get them through any delays in payment. In a recourse agreement, the factoring company does not offer the same protection in the event your customer goes bankrupt. For that reason, recourse agreements tend to be less expensive, in terms of rate, because the trucking company is assuming the risk of nonpayment from insolvency.

Recourse factoring is a great option if you know your customers will pay in a timely manner.

Recourse and non-recourse factoring have their similarities and differences, so carefully decide which type of factoring will benefit your company.

Invoice factoring helps with fuel advances and fuel cards

While you’re on the road, you may need additional cash to cover costs. This is why, when business owners look for factoring companies, they often search for those that offer fuel advances and discount fuel cards. Once you pick up a load, you can receive money to pay for fuel and other expenses. If you want a fuel advance, all you need to do is send a request that includes rate confirmation and a bill of lading. Once the request is approved, you’ll receive the advance in as fast as one hour.

When a factoring company provides you with a fuel advance, you won’t have to worry about negotiating an advance from a broker or shipper. This way, you can keep your trucks on the road and take on more loads with a predictable amount of money, even if you’re low on funds at first. When you begin to work with a factoring company, you’ll also be eligible for the fuel card program. A card gives drivers fuel rebates at major truck stop pumps across the country.

Some invoice factoring will even let you split your payment across different payment methods. Say you were paid $1,000 for a load. You can choose to get paid $500 to your fuel card and have the other $500 go to your bank account. A fuel card also gives you the flexibility of transferring to a single or multiple bank accounts.

Who can benefit from freight bill factoring?

At times, companies must wait a while for brokers and shippers to pay. Meanwhile, those companies also need to pay for drivers, fuel, repairs, and other expenses as they wait. Freight factoring services are an ideal solution. It’s a convenient, flexible option for trucking companies of all sizes. However, factoring is especially beneficial for startup companies that lack large cash reserves.

Whether you need to cover payroll, hire new drivers, or expand your fleet of trucks, payments from freight bill factoring are ideal. Also, if you need to improve your business credit, factoring is a great way to do so. You can quickly get paid for jobs, allowing you to pay off loans and pay your bills on time.

In addition, if you want to focus on your business and take on additional projects, you should consider factoring. Triumph offers free back office support and collections, so you can turn your attention to booking loads and hauling freight.

What are some of the benefits of factoring?

The invoice factoring process may be cheaper than traditional loan interest rates. Furthermore, while a cash advance loan may be convenient for your business in the short term, it may not solve your working capital needs over time or grow with you as your business grows.

There are options for every company’s requirements. There are invoice factoring agreements that have no-minimums, which means you can factor as little or as much as you want.

You qualify for factoring based on your customers’ credit, not your own. This means that even if you don’t qualify for a loan, you may still qualify for invoice factoring.

Some companies (like Triumph Business Capital) don’t require long-term contracts; you can factor on a month-to-month basis. But if factoring works for your business, you’re able to continue with it.

You get a team of back office professionals who will support your trucking company with its invoices, help run credit checks on brokers and collect payments.

How do I qualify for freight bill factoring?

Whether you own a small or large fleet, your trucking business can qualify for invoice factoring. The qualification process is mostly about your customers; if their credit is strong, you’ll likely qualify.

For more information regarding freight factoring services, contact Triumph’s experienced team of professionals. We’re a preferred partner, and a proud member of the International Factoring Association. We always make sure carriers receive payment on time, and we’ll positively maintain your relationships with your customers. Give us a call today!

Here are some additional pros and cons of truck factoring:

Pros:

Easy approval qualifications, including being open to business owners with bad credit

Fast funding

Good for cash flow gaps

Helps you cover expenses while you’re waiting for your customers to pay

No collateral required

With some non-recourse agreements, you’re guaranteed to receive at least some of the value of an invoice if your customer doesn’t pay

Cons:

High cost: a factoring fee of 2% for a 30-day advance of 80 percent of the invoice equates to a 34.4% APR on the amount advanced

Some factoring companies require minimum contract lengths or invoice amounts

The fee structure at some companies can be confusing

Your customers might be worried or offended if they’re contacted by a different company for payment. That will especially be the case if the factoring company uses aggressive collection methods.

With recourse factoring, you’ll have to pay off the invoice if your customer doesn’t

How to apply for trucking factoring

Many of the companies that offer truck factoring don’t have a minimum credit score requirement for approval. Others will provide loans to people with credit scores in the low 500s. BlueVine, for example, has a 530 credit score requirement.

Some companies may require you to have a minimum annual revenue — BlueVine requires $100,000 and Fundbox requires $50,000. Many of these companies will work with brand-new businesses; others may require three to six months in operation.

Applying for trucking factoring is very quick and easy, and funding can come as soon as a day or two.

The most common documents you’ll need to apply for trucking invoice factoring include:

Accounts receivable list

Accounts receivable aging

Customer list

Recent bank statements

Your company’s articles of incorporation

Sample invoice (along with supporting documents like contracts and purchase orders)

BlueVine

BlueVine offers both a business line of credit and invoice factoring to small businesses in multiple industries. There are no hidden fees with BlueVine, and it charges a flat 1% rate for each week your invoice is outstanding. To be eligible for its invoice factoring, you’ll need a personal credit score of 530 or more, three months in business operation and $100,000 in annual revenue.

Where BlueVine stands out

Unlike most factoring companies, if your account stays within good standing, BlueVine does not take over your company’s invoices. You still maintain control over the invoices and are responsible for collecting the payments, so your customers won’t know that you have factored your invoices.

Where BlueVine falls short

BlueVine requires a lien and a personal guarantee to secure the funding. That means that if your customer hasn’t paid by the end of their invoice term, you’re on the hook for paying the invoice. BlueVine also has higher standards for annual revenues, time in business and minimum credit score compared to some companies that offer trucking factoring that don’t have minimum requirements in those areas.

Additional benefits of BlueVine

BlueVine offers quick approval and funding. You also don’t have to provide any documentation if you agree to connect your bank account directly to BlueVine’s system.

TBS Factoring

Unlike the three other companies on this list, TBS Factoring offers invoice factoring solely to the trucking/transportation industry. The company offers both recourse and non-recourse factoring and handles collections on the borrower’s invoices.

Where TBS Factoring stands out

TBS Factoring does not hold back a reserve percent of an invoice, but offers 100 percent of the invoice value upfront for non-recourse factoring. That means a borrower gets all the invoice money even before a customer pays. The company also has no minimum credit score, time in business or revenue requirements for approval.

Where TBS Factoring falls short

Because TBS Factoring handles collecting on customer invoices, it can save you time, but it also may be confusing or concerning to your clients to be contacted by a different company to make their payments.

Additional benefits of TBS Factoring

TBS has no monthly factoring minimums and also offers perks like a fuel card program and free credit checks on your customers so you can choose the right invoices to finance.

Universal Funding

In business since 1998, Universal Funding works with B2B companies in multiple industries, including transportation/trucking. The company has no minimum credit score, time in business or annual revenue requirements for approval for its invoice factoring.

Where Universal Funding stands out

Unlike many factoring companies, Universal Funding has a monthly factoring fee instead of a weekly fee. That could potentially save you money if your client doesn’t pay their invoice right away.

Where Universal Funding falls short

If an invoice goes unpaid after 90 days, you’ll have to swap that invoice out for another one or buy the invoice back. Universal Funding also charges several additional fees, including a $35 credit approval fee and a $50 lock box fee.

Additional benefits of Universal Funding

On its website, the company clearly spells out its process for collecting on your customer’s invoice, including introducing themselves via a letter on your company letterhead.

832-706-63-68 |

210-946-9841

Start the Training Today, Spanish English

FORT WORTH – SAN ANTONIO – HOUSTON

AFFORDABLE CDL TRAINING IN CORPUS

Específicamente, le ofrecemos capacitación asequible: $1500. Además, le aseguramos que aprobará el examen DPS del DMV.

¿QUÉ INCLUYE?

Incluye, la prueba de lectura y las habilidades de inspección antes del viaje, la autoestima y la experiencia necesaria para conducir todos los días y no simplemente para aprobar la prueba estatal CDL clase “A”.

¿Dónde nos encontramos?

Ahora, estamos en Houston – San Antonio – Austin – Dallas.

Para concluir, haga clic aquí para comprender más sobre nuestras preguntas frecuentes sobre el servicio de alquiler de camiones CDL.

As a result, give us a call to schedule your first driving lesson.

CDL License Great Family Support!

If you are looking away to transform your life into a new career Truck Driving School Houston is the place to start, we have no hidden additional costs, the value is $ 1500 without hidden charges in CDL training, Houston, Laredo TX and Corpus Christi.

CDL SCHOOL HOUSTON

CDL truck training Houston has an affordable price, truck driving school Houston offers CDL training Houston $1500, you everything you need to get licensed and more like a job, endorsements of affordable class A CDL training! All for $ 1500 one to one To obtain your commercial driver’s license, you must pass the CDL Class A CDL tests in Houston, TX.

You are in the right place!

Price and experience giving training make a big difference CDL training is every day, but we can customize de schedulle, the CDL Class A license allows you to change the life of your family since the income for the year 2018 had never been seen.

CDL Training Houston Our Goal?

Applying bit by bit training we teaching you, CDL school Houston main goal is “You Obtain You CDL License class A without restrictions and employment to try and do that we have computer training, one-on-one air brakes and Pre-Trip-inspection training, teacher strategy training, we do almost everything needed to training you, hands on the truck possibly is the best method, and we do that.

CDL SCHOOLS IN HOUSTON

Yes, we are affordable and reliable source to reach the CDL license, CDL School Houston the total cost of training is $ 1,500, which is an affordable price for standard truck training, most schools require you to obtain your permit before the class begins and the cost is more than $ 6,000. At our school, you can study for permission from your home, office using a smartphone or a computer.

REQUIREMENTS TO START CDL TRAINING IN HOUSTON

It is not too difficult to get started in a CDL driving school Houston TX. Enrollment usually can be done online, and you just need to meet with the requirements being following.

- Be at least 18 years

- Have a driver’s permit that is valid

- Have a totally clean record. This is certainly driving

- Have a security card this is certainly personal

- Have a means of repayment when it comes to CDL training school

TRUCKING SCHOOLS HOUSTON TX

Whether you’ve always wanted to drive vehicles or perhaps you’re trying to find a career change and would like to study on the best at CDL School Houston TX, we can assist.

Our truck driving schools are easily situated over the national country. That can help you gain the abilities you’ll want to get yourself a job you are going to love—just a few great things about earning your course a motorist that is commercial License (CDL).

CDL CLASSES IN HOUSTON

Hands-on truck training, with enough time within the pre-trip and driving, CDL classes in Houston including time on our operating the truck on the road. Working hard and understanding the trucking industry – from the rig to cargo dealing with finishing your sign.

TRUCK SAFELY IMPORTANCE IN HOUSTON CDL TRAINING

Sound so that you (and everyone else on the road) Training shows you how to make safe on the road on the design that is late and transportation technology.

Working out, you will need to take up a vehicle work that is operating confidence.

You can earn your CDL rapidly. Our transportation Schools Houston TX school that is driving as low as one month to complete.

Knowledgeable teachers with decades of Class A knowledge – every one of whom wants you to grow and become successful.

DRIVING CDL HOUSTON TX

Truck drivers load goods from a single point out another, often traveling through multiple states and navigating roadway that is unpleasant climate conditions—in this system, Driving CDL Houston TX to prepare to earn a Class A Commercial Truck Driver’s License.

Gain an understanding of national and state laws, safety procedures, dangerous materials, bills of lading, loading and securing, and air braking system systems.

HOUSTON TRUCK DRIVING SCHOOL

Truckers Are owners for the safe, efficient delivery of goods between locations. Spend some time behind the wheel, learning how exactly to steer vehicles in many different real-world circumstances.

You will develop backing and skills that are operating classroom, lab, range, and roadway experiences. Non-technical abilities such as communications may be talked about additionally.

Fast Track CDL Dallas

BlogSubscribeOpening HoursMonday | 8am - 11pmTuesday | 8am - 11pmWednesday | 8am - 11pmThursday | 8am - 11pmFriday | 8am - 11pmSaturday | 8am - 8pmSunday | 8am - 8pmBook Appointment(255) 352-6258Contact1234 Divi St. #1000, San Francisco, CA...

BlogSubscribeOpening HoursMonday | 8am - 11pmTuesday | 8am - 11pmWednesday | 8am - 11pmThursday | 8am - 11pmFriday | 8am - 11pmSaturday | 8am - 8pmSunday | 8am - 8pmBook Appointment(255) 352-6258Contact1234 Divi St. #1000, San Francisco, CA...

TRUCKER HEALTH IMPORTANCE

TRUCKER HEALTH IMPORTANCE Nurturing Well-being on the Open Road Introduction: Trucker health importance is the backbone of our transportation industry, ensuring the delivery of goods that sustain our modern way of life. However, while their dedication keeps our...

LICENCIA CDL CAMBIA VIDAS

LICENCIA CDL CAMBIA VIDAS¡Descubre por qué la CDL es la llave hacia un futuro prometedor! Desbloquea tu potencial con una licencia de conducir comercial (CDL) y prepárate para abrir las puertas hacia un empleo bien remunerado. A diferencia de muchos trabajos...

ENTRENAMIENTO CDL ESPANOL TEXAS

ENTRENAMIENTO CDL ESPANOL TEXAS Entrenamiento CDL Espanol Texas CDL SCHOOL TEXAS Capacitación certificada en camiones somo una escuel cerificada ELDT, opción de pago de $ 2300, horario flexible que incluye fines de semana. Español, Houston, Fort Worth, San...

CDL FOR FEMALES

CDL FOR FEMALES Women make a positive difference in the trucking industry; every day, there are changes in the culture of the trucking industry; the trucking industry's way of thinking towards females has changed significantly in recent years. It is common for female...

CDL license Crime

CDL License Crime CDL license crime in testing is when you try to bribe or Kickbacks to the test officer this is Illegal and big trouble will come if you want to pass the CDL license, please Click Here To Get CDL. Intend to Bribing A CDL Tester Will Send You To The...

Texas DMV Written Test

Texas DMV Written Test Pass the written test of the DMV in Texas to get your commercial learners to permit or CLP, we need to start for the DOT medical Bring your medical certificate with you when you go to the DMV and take a written test at the DMV. You need to...

CDL Training Amarillo

Entrenamiento CDL Amarillo, TX Entrenamiento de CDL Amarillo, TX use calles en Amarillo para el entrenamiento de CDL, su fuerza de voluntad como erudito y nuestros instructores poseen numerosas millas de experiencia para tener la...

Semi Truck Brakes

Semi Truck Brakes Air brakes, hydraulic brakes, spring brakes in your truck because of their power by hydraulic pressure. 2 Buttons On The Tractor We also have parking brakes on large commercial vehicles. These do have to be applied every time you leave the seat....